Percentage of taxes taken out

What Percentage Is Taken Out Of Paycheck. What percentage of taxes are taken out of payroll.

Government Revenue Taxes Are The Price We Pay For Government

You must report that money as income on your 2019 tax return.

. Combined the FICA tax rate is 153 of the employees wages. FUTA only applies to the first 7000 of an employees income. These amounts are paid by both employees and employers.

Individuals who make up to 38700 fall in the 12 percent tax bracket while those making 82500 per year have to pay 22 percent. For 2022 employees will pay 62 in Social Security on the first 147000 of wages. This money will be taken out before your earnings hit your bank account.

Taxes that you pay on 401 withdrawals are also based on tax brackets. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. Also distributed in such a way that both the employer and the employee pay.

FICA taxes are commonly called the payroll tax. Tax on health insurance. How much tax is taken off a paycheck in Ontario.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. You can have 10 in federal taxes withheld directly from your pension and IRA distribution so that you would receive a net 18000 from. There are seven federal income tax rates in 2022.

Because theyre considered pre-tax contributions your total taxable income and thus the taxes you pay will go down. What is the percentage of federal taxes taken out of a paycheck 2022. For example lets say you elected to receive your lottery winnings in the form of annuity payments and received 50000 in 2019.

The individuals effective tax rate is approximately 135 of income. If you increase your contributions your paychecks will get. How Your Paycheck Works.

Discover Helpful Information And Resources On Taxes From AARP. 995 3668 2085 6748. Combined the FICA tax rate is 153 of the employees wages.

What is the percentage that is taken out of a paycheck. What percentage of taxes are taken out of payroll. This is because all employees are required to fill out a W-4 form Employees Withholding Allowance Certificate when hired at a company.

Federal income tax and FICA tax withholding are mandatory so theres no way around them unless your earnings are very low. What Is the Percentage of Federal Taxes Taken out of a Paycheck. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

That is a 10 rate. The top marginal income tax rate of 37 percent will hit taxpayers with. What are the federal withholding rates for 2022.

505 on the first 44470 of taxable income. It is distributed in such a way that both the employer and the employee pay. However theyre not the only factors that count when calculating your.

The information an employee provides on this form. And you must report the entire amount you receive each year on your tax return. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

There are also 24 32 35 and 37 percent tax brackets. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Multiply 0135 by 100 to convert to a percentage which yields 135.

The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total. There is a base salary cap for this tax. The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total.

How Much Does H r Block Charge To Do Taxes. If its a traditional IRA SEP IRA Simple IRA or SARSEP IRA you will owe taxes at. 915 on portion of taxable income over 44470 up -to 89482.

The good news is you only pay 10 on all income up to 9325 then 15 on income up to 37950 and so on. However they dont include all taxes related to payroll. Note that although this will result in slightly smaller paychecks each pay period your tax bill may turn into a refund come tax time.

The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. 1116 on portion of taxable income over 89482 up-to 150000.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Unlike most other states in the US Pennsylvania does not exempt contributions to 401ks 403bs and other retirement accounts from income taxes and. Ad Compare Your 2022 Tax Bracket vs.

If its not you will. If you earn wages in excess of 200000 single filers 250000 joint filers or. For a single person making between 9325 and 37950 its 15.

A single person making between 0 and 9325 the tax rate is 10 of taxable income. 6748 50000 0135. A notable exception is contributions to a Roth 401k which come out.

Money deposited in a traditional IRA is treated differently from money in a Roth. FICA taxes consist of Social Security and Medicare taxes. Divide total taxes by annual earnings.

Your 2021 Tax Bracket To See Whats Been Adjusted. You fill out a pretend tax return and calculate that you will owe 5000 in taxes. Meanwhile after taxes and benefits the take-home pay of an average single US.

That means your winnings are taxed the same as your wages or salary. Combined the FICA tax rate is 153 of the employees wages. Simplify Your Day-to-Day With The Best Payroll Services.

Your Federal Income Tax You would be taxed 10 percent or 900 which averages out to 1731 out of each weekly paycheck. What percentage is deducted from paycheck. There is no universal federal income tax percentage that is applied to everyone.

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

Sales Tax Anchor Chart Math Anchor Charts Anchor Charts 7th Grade Math

Tax Deductions For A Home Office Infographic Home Office Home Office Decor Home Office Organization

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Government Revenue Taxes Are The Price We Pay For Government

Pin On Sociology Visuals Economy

Don T Wait Till Its Time To File Your Tax Return The Key To Lowering Your Federal Tax Liability Is To Take Action Now For More T Tax Brackets Tax Return Tax

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

2022 Federal State Payroll Tax Rates For Employers

Taxes On Americas Favorite Beverage Soda Infographic Soda Tax Infographic Health Food Infographic

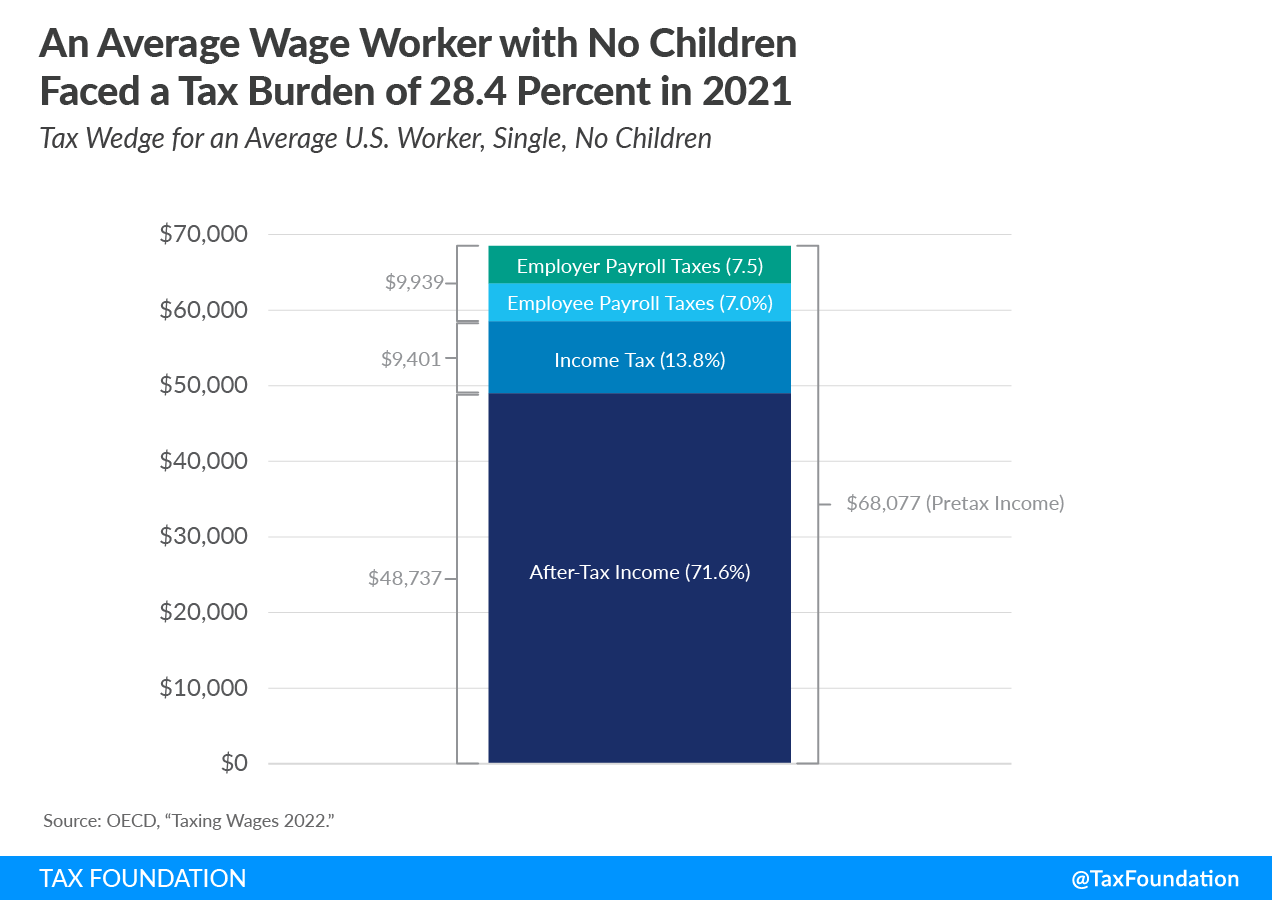

Tax Wedge Taxing Wages Details Analysis Tax Foundation

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center